Urgent action needed to prevent retirement disability benefit ‘timebomb’ – report

Report finds total number of retired benefits recipients likely to rise by 60 per cent in next decade, with costs expected to rise to £10.5bn.

A significant increase in the number of people spending a decade or more of their retirement on disability benefits is expected unless urgent preventative action is taken, according to new research from consultancy firm LCP.

Although much of the public discussion around ‘economic inactivity’ focuses on those of working age in receipt of benefits for those unfit to work, these benefits stop at pension age, when individuals switch to a state retirement pension. By contrast, disability benefits such as Personal Independence Payments (PIP) continue to be paid throughout retirement for those already eligible when they retire. The new analysis suggests that unless action is taken to improve the health of these individuals, the cost of funding these benefits will rise significantly in the coming years.

The research finds that just under 100,000 people aged 66 (the state retirement age) are currently in receipt of PIP or its predecessor, Disability Living Allowance (DLA), and are expected to draw these benefits for another 11 years, on average. It estimates that of those individuals, half will continue claiming PIP until they die. The total payment per person would be around £70,000, but this could rise for individuals on low incomes and those claiming means-tested benefits.

Without mitigation, the total number of pensioners on PIP/DLA is likely to rise by around 60 per cent in the next decade, from approximately 1 million now to 1.6 million in 2023, LCP’s research suggests. The total cost of funding these benefits would rise from around £6bn to £10.5bn.The total current cost of PIP in 2023/24 is £21.8 billion, and the benefit is paid to 3.2m people.

The number of adults in receipt of PIP (plus DLA) has risen by around 1 million in the last decade and is forecast by DWP to rise by another million in the next three years. For younger PIP recipients, the fastest growing reported health condition is mental health problems, whereas, for older claimants, it is more likely to be musculoskeletal complaints. The fastest growing group of recipients is those who have been in receipt for five years or more, suggesting a risk of a large and growing ‘core’ of recipients with a dwindling prospect of flowing off benefit at all.

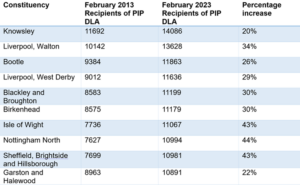

Looking at all PIP/DLA recipients aged 16 or over, receipt of benefits is heavily concentrated in more deprived areas. The table (below) shows the 10 parliamentary constituencies with the highest absolute numbers of PIP/DLA recipients as of 2023, and how the number has changed in the last decade. Five of the top six are in the Merseyside area, and all have seen a growth in numbers of between 20-30 per cent in the last decade.

If targeted action is not taken, many of the working age claimants in these areas will reach pension age on disability benefits and then be more likely to die in receipt than cease claiming.

The higher levels of benefit receipt in more deprived areas suggest the potential for targeted health interventions, which could reduce the number of people who need to claim in the first place and/or reduce the length of claim for those who do receive benefits. However, the authors argue that past government interventions have proven insufficiently focused on those most in need.

The research cites as an example the DWP’s recent expansion of the “Individual Placement and Support in Primary Care Programme” (IPSPC), which was designed to support individuals in receipt of disability benefits. However, the list of local authorities chosen to date excludes those where disability benefit receipt is at its highest.

Another example is NHS England’s ‘Elective Recovery Programme’, which aims to increase capacity to tackle the waiting list backlog that significantly worsened during the Covid-19 pandemic. This programme has not specifically prioritised areas of greatest unmet health need, according to the researchers.

The paper argues that with each person who reaches pension age on PIP likely to receive another £70,000 in benefit on average, there is great potential for cost-effective interventions which would benefit the individuals concerned as well as the taxpayer. For example:

- Clinically recommended Diabetes meters for those with Type-2 Diabetes cost just £5.50 each; roughly 13,000 such meters could be funded from the savings of just one person fewer needing PIP through retirement.

- Where people have mental health problems alongside physical problems, low intensity psychological treatments have been demonstrated to be a cost-effective method of treatment. The cost of such ‘collaborative care’ is around £2,140 per person, a fraction of the potential cost saving of £70,000 through avoided benefit payments.

Commenting on the results, co-author and Head of Health Analytics at LCP, Dr Jonathan Pearson-Stuttard, said: “The prospect of large numbers of people going into retirement facing long-term disability benefit receipt is not in the interests of the individuals concerned or the taxpayer. If just one less person needs to claim Personal Independence Payment through retirement the saving is likely to be around £70,000 and that money could be much better spent keeping people well and supporting those who have disabilities. More targeted interventions, particularly focused on areas of greatest deprivation and highest health needs, could pay off many times over in terms of benefit savings and gains to the wider economy.”